Analysis of the Disruption Caused by Electrical Vehicles in the Automotive Industry (Homework "Technology Strategy: Creative Destruction")

In an effort to get a more formal understanding of the mechanics of technology implementation, I am following the Coursera course "Technology Strategy: Creative Destruction". To digest and memorize the content, I decided to apply my learning and write a "homework".

In this first article, we will cover the content of the first module. That is, the concepts of innovation adoption lifecycle, product lifecycle, technology S-curve, and industry lifecycle. To make it a bit a more interesting, we analyze the disruption in the automotive industry caused by electrical vehicles (EVs). As usual, the writing is supported by GenAI (you.com and GPT-4o).

Analysis of the Disruption Caused by Electrical Vehicles in the Automotive Industry

Introduction

The automotive industry is undergoing a significant transformation due to the advent of electric vehicles (EVs). This disruption is reshaping the competitive landscape, compelling traditional car manufacturers to adapt or risk obsolescence. This analysis will explore the EV disruption through the lenses of the innovation adoption lifecycle, product lifecycle, technology S-curve, and industry lifecycle. We will compare EV innovation to past automotive innovations and outline what this disruption means for traditional car makers. Additionally, risks and opportunities will be identified, and parallels will be drawn with other industries that have experienced similar disruptions.Innovation Adoption Lifecycle

The innovation adoption lifecycle is a model that describes the adoption or acceptance of a new product or innovation, categorized by different types of adopters:- Innovators (2.5%): The first individuals to adopt an innovation.

- Early Adopters (13.5%): Opinion leaders who embrace new innovations early but carefully.

- Early Majority (34%): Individuals who adopt an innovation after a varying degree of time.

- Late Majority (34%): Skeptical individuals who adopt an innovation after the average participant.

- Laggards (16%): The last to adopt an innovation, typically due to aversion to change.

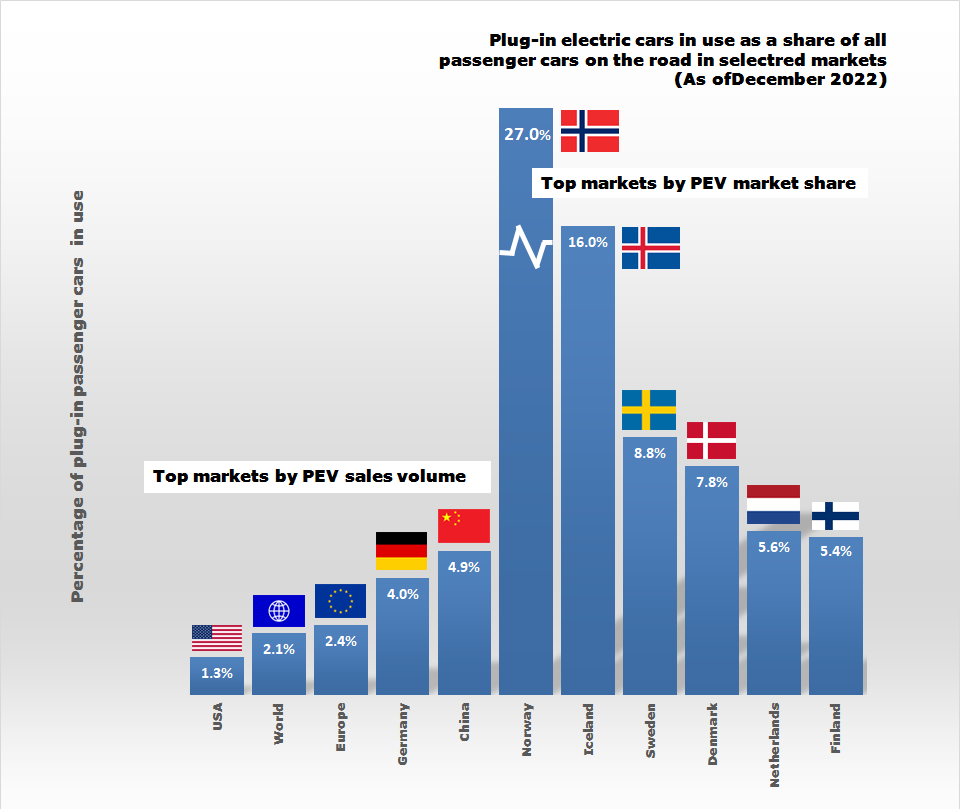

Arguably, EVs are currently transitioning from the early adopter phase to the early majority phase worldwide. In 2022, the share of EVs (incl. plugin-hybrids) of new car sales worldwide was 14%, but varies widely across markets (see Figure below).

Moreover, it is important to note that the share of EVs in use (rather than new sales) is still significantly lower at 2.4% worldwide, 2.4% in the EU, 4.9% in China and only 1.3% in the USA. Norway has the highest share with 27%.

Early adopters might have been driven by environmental

concerns, technological enthusiasm, and government incentives, whereas the early majority considers more pragmatic reasons. As

battery costs decrease and charging infrastructure improves, the early

majority is starting to embrace EVs, leading to accelerated market

penetration.

While ICE vehicle sales worldwide remain significantly higher, it is worth noting that they are decreasing since 2018:

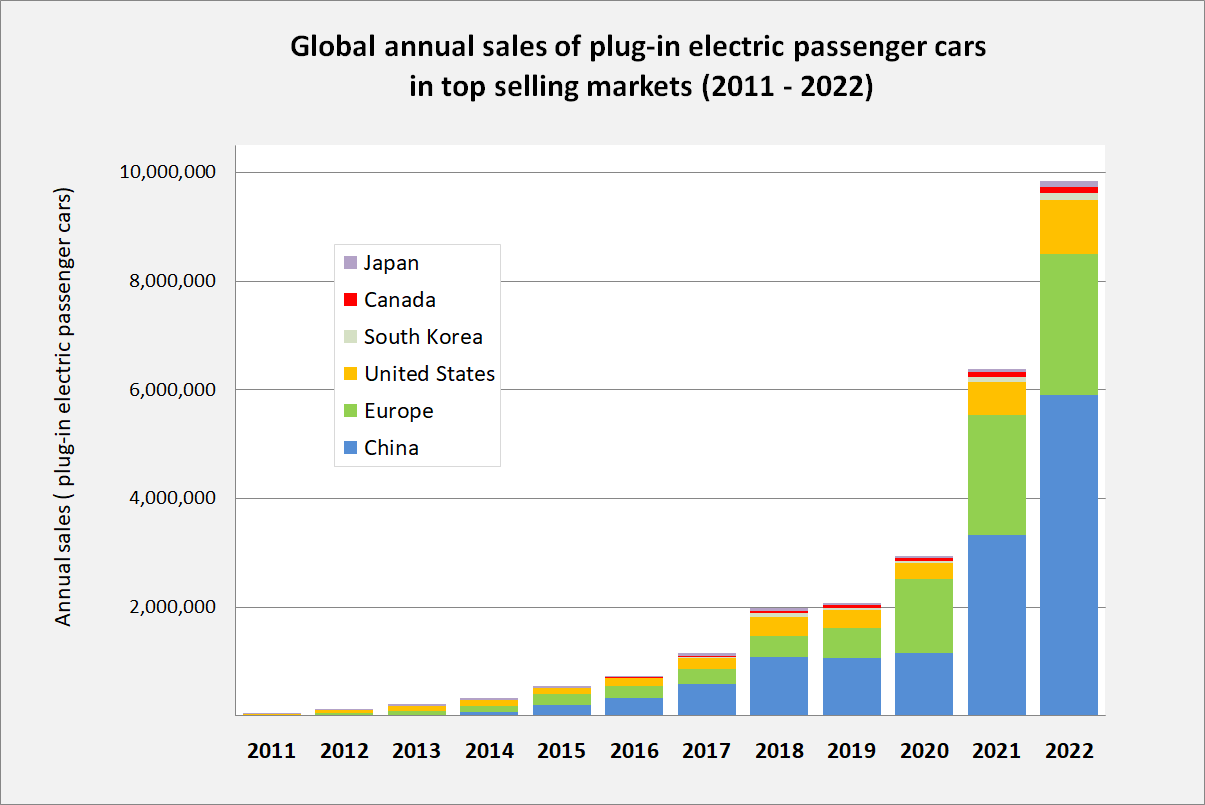

Traditional automakers are currently in the maturity or even decline stage, facing disruption from EVs, which are in the growth stage as indicated by the sales figures (see above).

Product Lifecycle

The product lifecycle describes the stages a product goes through from introduction to decline:- Introduction: EVs were in this stage during the early 2000s when models like the Tesla Roadster debuted in 2008.

- Growth: The market is now witnessing rapid growth, characterized by increased sales, expanding product lines, and heightened consumer awareness.

- Maturity: The market is expected to reach maturity when EV adoption becomes widespread, and growth rates stabilize.

- Decline: Eventually, EVs will enter a decline phase when a new disruptive technology emerges.

Sales figures indicate that the EV market has entered its growth phase:

While ICE vehicle sales worldwide remain significantly higher, it is worth noting that they are decreasing since 2018:

Technology S-Curve

The technology S-curve illustrates the performance improvement and adoption rate of a technology over time:- Emerging Phase: Initial slow performance improvement and adoption.

- Growth Phase: Rapid performance improvement and accelerated adoption.

- Maturity Phase: Performance improvement slows down as the technology reaches its limits.

Industry Lifecycle

The industry lifecycle encompasses the stages an industry goes through:- Introduction: The introduction of the automobile in the early 20th century.

- Growth: The industry experienced growth through mass production techniques pioneered by Ford.

- Shakeout: The industry consolidated, with weaker players exiting the market.

- Maturity: Dominance by a few key players (e.g., GM, Ford, VW, Toyota).

- Decline: Potential decline as new technologies (e.g., EVs) disrupt the market.

Traditional automakers are currently in the maturity or even decline stage, facing disruption from EVs, which are in the growth stage as indicated by the sales figures (see above).

There might be signs of an early shake-out with prominent EV companies like Fisker filing for bankruptcy and an increasingly challenging environment for startups to secure investments.

Comparison to Earlier Innovations

EV innovation can be compared to the introduction of the internal combustion engine (ICE) and the mass production of cars:- ICE: Revolutionized mobility and led to the decline of horse-drawn carriages.

- Mass Production: Ford's assembly line significantly reduced costs and made cars accessible to the masses.

- EVs: Represent a paradigm shift focusing on sustainability and advanced technology.

Implications for Traditional Car Makers

Risks:- Market Share Loss: Failure to adapt could result in significant loss of market share to EV-focused companies.

- Stranded Assets: Investments in ICE manufacturing facilities may become obsolete.

- Brand Erosion: Perception as outdated or environmentally unfriendly could damage brand reputation.

- New Revenue Streams: Entry into the EV market can open new revenue opportunities.

- Sustainability Leadership: Embracing EVs can position traditional OEMs as a leader in sustainable mobility.

- Technological Innovation: Investment in EV technology can spur innovation and improve overall product offerings.

Comparison to Other Industries

Similar disruptions have occurred in other industries:- Telecommunications: The shift from landlines to mobile phones.

- Retail: The transition from brick-and-mortar stores to e-commerce.

- Media: The move from physical media (CDs, DVDs) to digital streaming.

Conclusion

The disruption caused by EVs is a critical inflection point for the automotive industry. Traditional car makers like VW must navigate this transition by leveraging their strengths while embracing new technologies and business models. The risks are substantial, but the opportunities for those who successfully adapt are even greater. By learning from other industries that have faced similar disruptions, VW and its peers can develop strategies to thrive in this new era of automotive innovation.Addendum

Signs for Crossing or Not Crossing the Chasm in the Adoption Lifecycle of Electric Vehicles

The chasm is a critical gap between the early adopters and the early majority in the innovation adoption lifecycle, representing a significant challenge for new technologies to gain mainstream acceptance. This concept, popularized by Geoffrey Moore in his book "Crossing the Chasm" highlights the difficulty in transitioning from a niche market of enthusiasts to a broader, more pragmatic customer base. Successfully crossing the chasm is crucial for ensuring that an innovation can achieve widespread adoption and long-term viability.Since EV adoption has not reached the "Early majority" phase, we want to investigate the likelihood of crossing the chasm in subsequent sections.

Signs Indicating Crossing the Chasm

- Increased Market Penetration: A significant increase in the market share of EVs, particularly among the early majority, indicates that EVs are crossing the chasm. For instance, the adoption of the Tesla Model 3 has been a breakthrough moment, driving early majority adoption due to its affordability and performance.

- Mainstream Consumer Acceptance: When mainstream consumers, who are typically more pragmatic and risk-averse, start recognizing the benefits of EVs, such as lower total cost of ownership and environmental advantages, it suggests that the chasm is being crossed.

- Improved Infrastructure: The expansion of charging infrastructure and the reduction in charging times are critical factors that make EVs more appealing to the early majority. Enhanced infrastructure reduces range anxiety and increases convenience, which are significant barriers for mainstream consumers.

- Government Policies and Incentives: Supportive government policies, such as subsidies, tax incentives, and stricter emission regulations, can accelerate the adoption of EVs by making them more financially attractive to the early majority.

- Positive Word-of-Mouth and Social Proof: As more early adopters share their positive experiences with EVs, it builds trust and reduces perceived risks for the early majority. This social proof is crucial for crossing the chasm.

Signs Indicating Not Crossing the Chasm

- Slowing Sales Growth: If the growth rate of EV sales starts to plateau or decline, it may indicate that the market is struggling to move beyond early adopters. For example, some reports suggest that EV sales in certain regions are not meeting expectations, which could be a sign of difficulty in crossing the chasm.

- Supply Chain and Production Issues: Persistent production constraints and supply chain issues can hinder the ability to meet growing demand from the early majority. This can create a bottleneck, preventing the market from crossing the chasm.

- High Costs and Limited Models: If EVs remain significantly more expensive than their internal combustion engine counterparts and if there are limited model options, mainstream consumers may be reluctant to make the switch.

- Insufficient Charging Infrastructure: A lack of widespread and reliable charging infrastructure can deter the early majority from adopting EVs, as convenience is a critical factor for this group.

- Negative Public Perception: Any negative publicity or widespread issues related to EVs, such as battery fires or reduced range in cold weather, can create skepticism among the early majority, making it harder to cross the chasm.

Likelihood of Crossing the Chasm

Given the current trends and developments in the EV market, the probability of crossing the chasm appears to be high. Factors such as increasing consumer awareness, technological advancements, supportive government policies, and expanding infrastructure all contribute positively to this transition. However, challenges like production constraints and market saturation in certain regions need to be addressed to ensure sustained growth.Sources

- Wikipedia article about the Technology adoption lifecycle

- Paper first introducing the technology adoption lifecycle: Beal et. al, The Diffusion process (1956), https://ageconsearch.umn.edu/record/17351?v=pdf

- Electric car use by country

- Electric Car Adoption – “Crossing the Chasm”

- Crossing the Chasm

- ICE Sales Peaked in 2017, EV Market Continues to Grow

- Industry life cycle and characteristics

- Fisker files for bankruptcy protection in wave of EV startups, moment of déjà vu for its founder

- EV startup Fisker files for bankruptcy, aims to sell assets

Kommentare

Kommentar veröffentlichen